The American job market may be shifting into a lower gear this spring, a turn that economists have expected for months after a vigorous rebound from the pandemic shock.

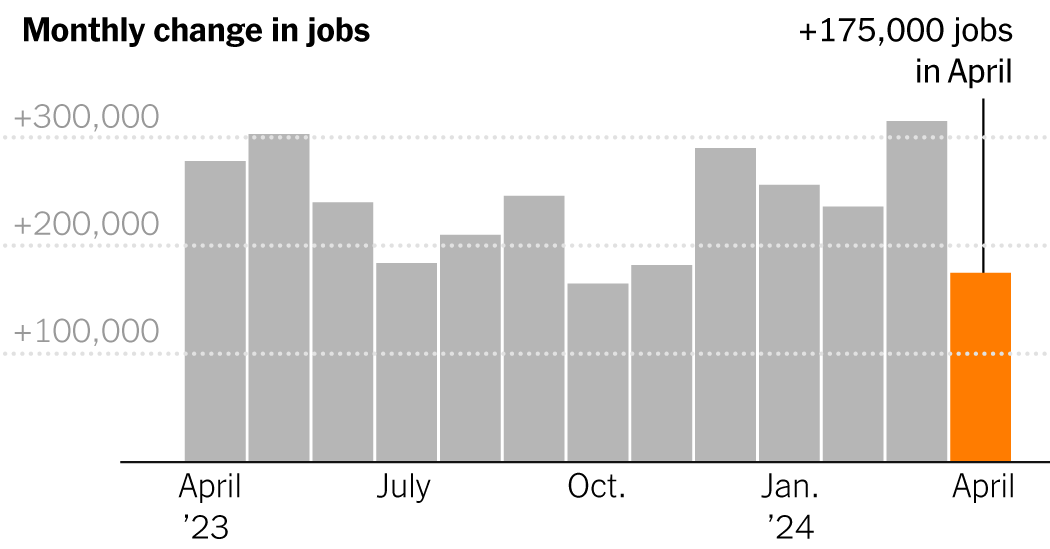

Employers added 175,000 positions in April, the Labor Department reported Friday, undershooting forecasts. The unemployment rate ticked up to 3.9 percent.

A less torrid expansion after the 242,000-job average over the prior 12 months isn’t necessarily bad news, given that layoffs have remained low and most sectors appear stable.

“It’s not a bad economy; it’s still a healthy economy,” said Perc Pineda, chief economist at the Plastics Industry Association. “I think it’s part of the cycle. We cannot continue robust growth indefinitely considering the limits of our economy.”

The labor market has defied projections of a considerable slowdown for over a year in the face of a rapid escalation in borrowing costs, a minor banking crisis and two major wars. But economic growth declined markedly in the first quarter, suggesting that the exuberance of the last two years might be settling into a more sustainable rhythm.

Wage growth eased, with average hourly earnings up 3.9 percent from a year earlier, compared with 4.1 percent in the March report. Swift wage growth in the first quarter, evidenced by a hotter-than-expected Employment Cost Index reading, may have partly reflected raises and minimum-wage increases that took effect in January as well as new union contracts.

The number of hours worked per week sank, another signal that employers need less staffing. A broader measure of unemployment that includes people working part time for economic reasons edged up to 7.4 percent, from record lows in late 2022.

The findings may be welcome news for the Federal Reserve, which has held interest rates steady as inflation has remained stubborn. Although the Fed chair, Jerome H. Powell, said this week that he wasn’t targeting lower wage growth, he added that sustained hot pay gains could prevent inflation from subsiding.

Bond yields fell on the new data, indicating a belief that the Fed may cut rates this year after some doubt that it would do so, and stocks rallied.

President Biden celebrated the report as a continuation of the “great American comeback,” but his presumptive rival in the November election, former President Donald J. Trump, characterized it as “HORRIBLE JOBS NUMBERS” on his Truth Social platform. Under Mr. Trump’s presidency, before the pandemic took hold in March 2020, monthly job increases averaged about 180,000 — just a tad higher than April’s gain.

The April showing is in line with other indicators of slackening conditions that have mounted in recent months: Job openings have fallen substantially from their peak two years ago, and workers are quitting their jobs at lower rates than they were before the pandemic. And the hiring figures for February and March, which came in higher than forecast, may have been flattered by an unusually warm winter.

“We’ve seen a significant easing in labor demand, and it’s not a surprise that hiring is also slowing down in this economic environment where interest rates are still elevated,” said Lydia Boussour, a senior economist at the consulting firm EY-Parthenon.

Employment growth has been narrowing to a few industries, and that trend held in April’s seasonally adjusted numbers, with health care — which is powered by aging demographics and doesn’t fluctuate as much with economic cycles — accounting for a third of the growth.

Leisure and hospitality employment rose only slightly, arresting what had been fairly swift growth as the industry approaches its prepandemic staffing levels.

The effect of higher interest rates has been clearly visible in manufacturing, a capital-intensive sector where employment has essentially been flat since late 2022. Federal incentives for the production of semiconductors and clean energy equipment are generating investment, but the employment impact has been muted.

That’s true at Voith Hydro in York, Pa., a maker of machinery for dams and pump storage facilities, which are a way to manage electricity demand. Some orders have been accelerated by the Infrastructure Investment and Jobs Act, and a tax break in the Inflation Reduction Act recently supported the installation of new equipment.

While Voith signed a new contract with its unionized workers last year with better wages and benefits to remain competitive with nearby employers, its work force of 350 hasn’t notably expanded.

“There are fewer people entering the trades, and there’s a smaller pool of people to pick from,” said Carl Atkinson, vice president of sales and marketing for the hydropower division. “That simply is challenging a whole group of manufacturers to be more efficient.”

That strategy has contributed to strong productivity growth over the past several quarters, which has helped wages to rise faster than prices. Depending on how many people start looking for work, such efficiencies might also prompt the unemployment rate to drift higher. But so far, the supply of workers has been a critical factor propelling the surprisingly strong employment growth of the past two years.

Part of that stems from the increased flow of both legal and undocumented immigrants, which added about 80,000 workers monthly to the labor force last year, according to calculations by Goldman Sachs, and will add another 50,000 per month this year. Economists at the Brookings Institution estimated that immigration would allow 160,000 to 200,000 jobs a month to be added in 2024 without fueling inflation.

But the availability of workers has also been amplified by women between the ages of 25 and 54 — generally considered prime working years — who set a labor force participation record of 78 percent in April.

Among those back in the job market this year is Juliette Gore, 46, who worked in sales for the credit reporting company Equifax before taking time off to raise her three sons. She then started a computer networking equipment business with her husband in an Atlanta suburb, but sold her stake when they divorced in 2022.

After taking a year to renovate her house, Ms. Gore started looking for jobs in early 2024. It turned out to be bad timing, as professional services employers had been pulling back after a period of rapid hiring. She sent dozens of applications but has landed only two interviews, and the closest thing to a job offer paid far less than she would accept.

“I feel it’s going to take much longer than I anticipated,” Ms. Gore said. “Some are saying things won’t look up until early next year.”

Declining job availability may also be pushing some people to turn to gig employment, which doesn’t show up in the monthly employer survey. According to a Bank of America analysis of its own data, the share of accounts with app-based income reached a record high in the first three months of this year, mostly from ride-sharing income.

A rising unemployment rate could restrain spending by consumers, who have also been burning through bank balances built during the pandemic, but still leave an economy that’s still fundamentally sound.

“We are still forecasting what we’d call a modest slowdown, but we’ve got the picture improving again,” said Stephen Brown, deputy chief North America economist for Capital Economics. “For the average worker, it’s not going to feel like a slowdown.”