Table of Contents

Labor pains

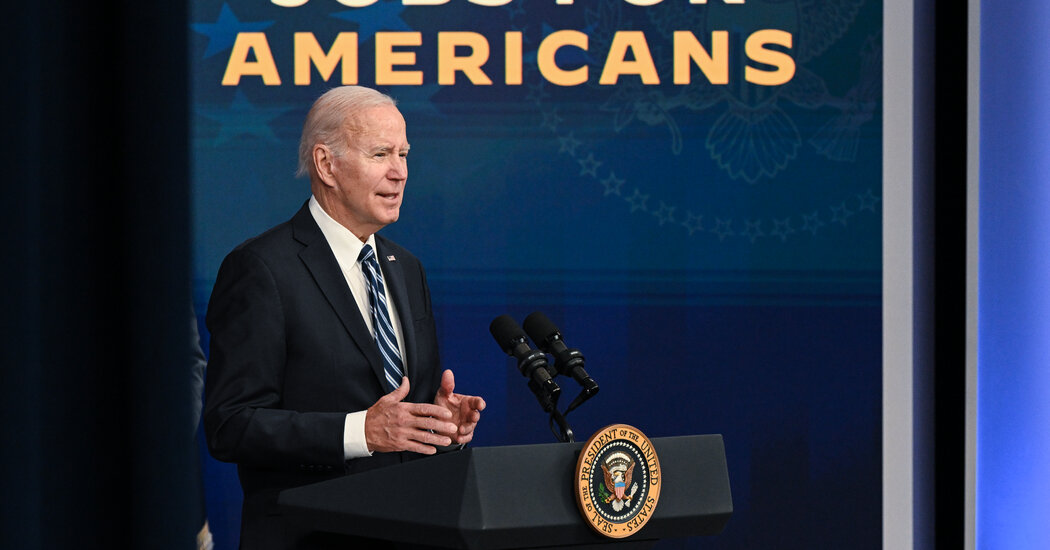

One of the more puzzling aspects of the U.S. economy is that employers have been on an almost uninterrupted hiring spree since President Biden took office — and analysts see no signs that the trend will reverse any time soon.

The paradox is that there is no guarantee that the jobs boom will keep Biden in the White House beyond November, completely scrambling the adage “It’s the economy, stupid” that wins elections.

For 39 straight months, employers have added jobs despite many predictions that the United States was destined for a recession. They have also faced a long list of challenges, that have hobbled many of America’s peers, including high inflation and interest rates; wars in Ukraine and Gaza that have sent energy prices soaring; and shipping turmoil in the Panama Canal, Red Sea and now the Port of Baltimore.

March was another blockbuster for jobs. The latest data released Friday overshot analysts’ expectations by a huge margin, with employers adding 303,000 jobs. That takes the tally over the past 12 months to more than 2.8 million hires — and economists expect the upward course to continue. “We do think there’s still room for growth” into next year, Jeremy Schwartz, a senior U.S. economist at Nomura, told DealBook.

It’s less certain if Biden will be able to capitalize on that in his race with Donald Trump. The White House heralded the latest numbers as “a milestone in America’s comeback,” and held it up as proof that the Inflation Reduction Act and CHIPS Act, two signature pieces of Biden’s agenda, were growing the economy.

But the red-hot labor market could just as easily exacerbate two of Biden’s big vulnerabilities: inflation, with strong wages fueling a surge in spending that pushes up prices on everything from gasoline to concert tickets; and higher-for-longer interest rates to counteract those price rises. A growing chorus of Wall Street analysts were forecasting that the Fed would be in no rush to reduce borrowing costs after yesterday’s report.

(By yesterday’s market close, traders had pushed back their predictions for the Fed’s first rate cut to come in July, rather than in June.)

Biden’s polling numbers are hovering near those of many one-term presidents. Voters say they disapprove of his handling of the economy, even though he’s presiding over, according to many indicators, a worldbeater. “When it comes to the economy, the vibes are at war with the facts, and the vibes are winning,” The Wall Street Journal’s Greg Ip wrote this week.

Some doubters are beginning to change their tune. Yesterday’s jobs report “calls our bear case for the economy into question,” Thomas Simons, an economist at Jefferies who had predicted that the United States would fall into recession this year, wrote in an investor note. Mohamed El-Erian, an economist and adviser at Allianz, has had a similar conversion. He told Bloomberg TV that the latest job numbers “confirm U.S. economic exceptionalism.”

There is still plenty of bad economic news. Americans (young and old) are concerned about their retirement savings. They’ve also racked up credit card debt, and their savings are dwindling.

But the labor market remains a bright spot. Wages are growing, as is the labor-participation rate, which climbed from 62.5 percent to 62.7 percent as 469,000 people joined the work force last month. The postpandemic economic recovery has resulted in broad gains across racial and income divides, Schwartz said.

Nomura watches a particular metric to measure an incumbent’s chances: the “misery index.” It’s a simple calculation that adds the inflation rate to the unemployment rate. Presidents with a higher misery index number have tended to lose their bids for re-election.

Biden’s distress rating has remained relatively high throughout his presidency. But that number has come down in line with the inflation rate, and the latest jobs report should cut it further.

The question is whether Biden’s misery index will fall far enough to put him in the range of Ronald Reagan and Barack Obama, who rode late economic recoveries in their first terms to win again — or will he stick closer to President George H.W. Bush, who lost Round 2 in 1992?

In other words, will voters give Biden credit for the jobs, or blame him for inflation?

IN CASE YOU MISSED IT

Bob Iger and Disney won a proxy fight against Nelson Peltz. Shareholders of the entertainment giant rejected the financier’s efforts to win board seats for the second time in two years. The victory ends an expensive fight that was a distraction for the company as it faces big challenges, including revamping ESPN, spending billions to update theme parks and figuring out the future of Hulu.

Tesla sales plummet. Elon Musk’s electric vehicle company reported its first quarterly year-on-year sales decline since 2020, and warned of “notably lower” growth this year. Tesla’s results reflected a wider slowdown in the E.V. market, but some prominent investors also blamed Musk’s “toxic behavior” for damaging the brand. Tesla stock has fallen more than 30 percent this year.

Endeavor plans to go private as part of a deal with Silver Lake. Ari Emanuel’s company, which owns the talent agencies IMG and WME, will stop operating as a listed entity three years after going public. Silver Lake will buy the shares of Endeavor that it doesn’t already own in a deal that values Endeavor at about $13 billion. The company failed to achieve its ambitious plans to turn itself into a media powerhouse that produced content as well as representing top stars like Dwayne Johnson and Oprah Winfrey.

Microsoft splits Teams from Office as regulatory scrutiny intensifies. The tech giant will separate its video and document collaboration program from its business software suite after rivals including Slack and Zoom complained that bundling them was anti-competitive. American and European regulators have ratcheted up their inquiries into Microsoft after a series of deals in recent months, including the company’s investments in A.I. start-ups such as OpenAI and Mistral.

On our radar: ‘Face-Off: The U.S. vs China’

The United States and China have tried to stabilize relations in recent months, but the underlying tensions between the world’s two biggest economies aren’t about to end anytime soon. Treasury Secretary Janet Yellen criticized Beijing on a trip to China in recent days, accusing it of “coercive actions against American companies” and warning that its state-backed manufacturers were distorting global markets.

The sharp rhetoric comes just days after a parade of chief executives met China’s president, Xi Jinping — a sign that they want to remain engaged there despite the evident challenges.

“Face-Off: The U.S. vs China” is an eight-part podcast beginning Tuesday that seeks to explain the relationship and why the dangers are so high. The series is hosted by Jane Perlez, a former New York Times Beijing bureau chief who is now at Harvard’s Kennedy School, and features a leading historian, Rana Mitter. Perlez told DealBook that the goal was to offer listeners “a rational approach” to understanding one of America’s biggest challenges.

Perlez and Mitter discuss everything from Apple’s remarkable rise in China and the future of Taiwan to Chinese espionage and Biden and Xi’s personal relationship, and they interview diplomats, spies, tech and military experts — even Yo-Yo Ma.