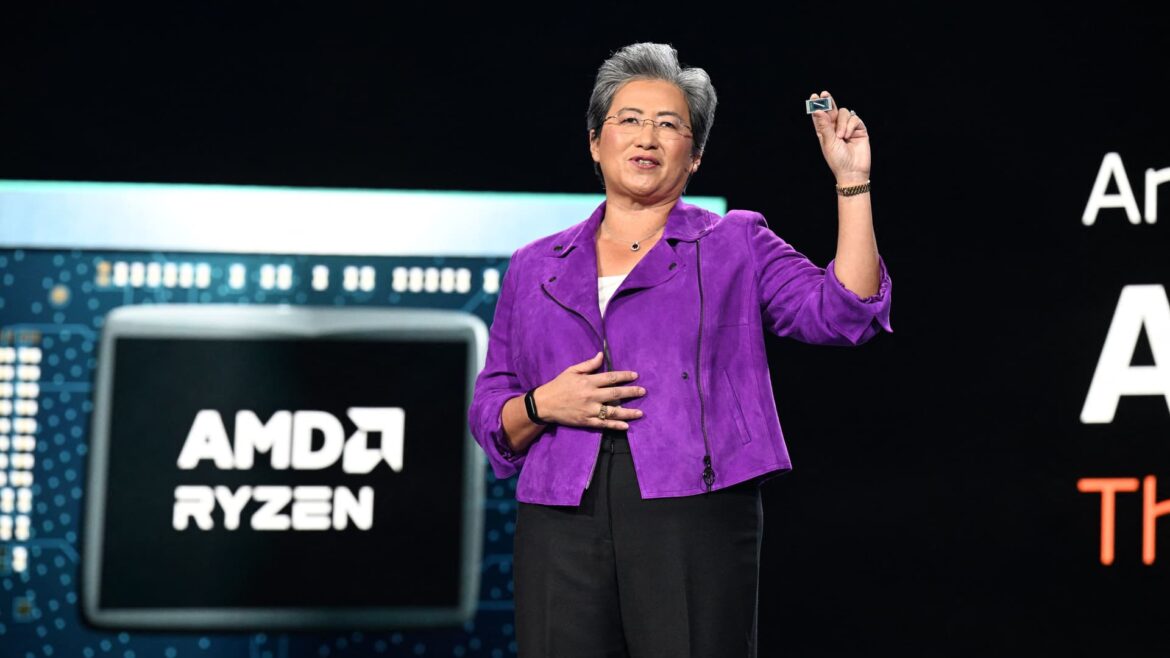

Jim Cramer’s daily rapid fire looks at stocks in the news outside the CNBC Investing Club portfolio. Target : Shares popped 12% after the retail chain reported better-than-expected earnings. “Target’s inventories were very low,” Jim Cramer said. Even though Target’s comparable stores fell for the third straight quarter, the retailer was able to boost profits and margins. “That’s called leverage. I’ve been waiting for that to happen for a very long time. It’s very good news for the next two quarters,” Cramer said. Advanced Micro Devices : Shares fell nearly 2% Tuesday. Late Monday, Bloomberg News reported that the U.S. government told AMD that its AI chips for the Chinese market required a license in order to comply with the Biden administration’s export controls. “If this stock comes in, you really want to buy it,” Cramer said. Cramer’s Charitable Trust, the portfolio used by the CNBC Investing Club, owns shares of Nvidia, the leading maker of AI chips. Gitlab : Shares plunged more than 17% after the software company issued a soft revenue forecast. In its recently concluded fiscal year, Gitlab’s revenue rose 37% on annual basis. However, Cramer noted its full-year sales guidance calls for growth in the mid-20% range. “It’s killing the stock, just killing it,” Cramer said. Tesla : The electric vehicle maker saw its stock fall nearly 5% Tuesday amid weak China shipment numbers and a temporary halt to operations at its German factory. Shares have fallen more than 27% year to date. “It was magnificent,” Cramer said, referring to the fact earlier in 2024 he called for Tesla to be removed from the group of so-called Magnificent Seven stocks. AeroVironment : Shares surged 28% after the maker of drones reported earnings per share that nearly double estimates and issued a strong forecast. “They’re getting the orders, and that’s what is driving it,” Cramer said.

previous post